House of Reps Approves Tinubu’s Tax Reform Bills

By Parrot Newspaper

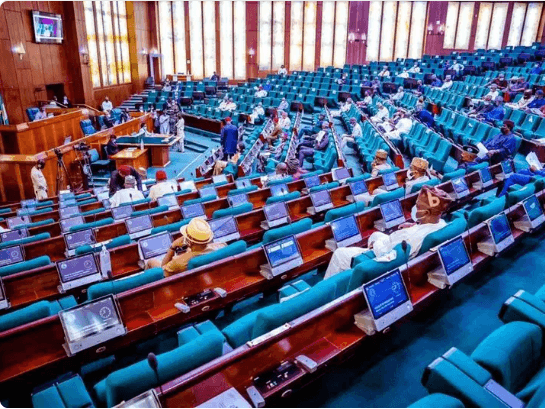

After months of heated debate and opposition from key stakeholders, the Nigerian House of Representatives on Thursday approved President Bola Ahmed Tinubu’s tax reform bills.

The approval, which was confirmed by Presidential spokesperson and Special Adviser on Media and Public Communications, Sunday Dare, has reignited discussions on the contentious provisions of the reforms. Dare, in a statement posted on his official X account, announced the passage of the bills but did not provide further details.

“Tax reform bills have been approved by Nigeria’s House of Representatives today in Abuja. Today, March 13, 2025,” he stated.

Contentious Tax Derivation Model

A major point of contention in Tinubu’s tax reform agenda has been the proposed value-added tax (VAT) derivation model. The Northern Nigeria Governors’ Forum (NNGF) was among the first to reject the model, arguing that it disproportionately favors wealthier states with higher commercial activities to the detriment of less industrialized northern states.

The National Economic Council (NEC) also raised concerns over the derivation formula, warning that it could deepen existing economic inequalities between regions. The council emphasized the need for a tax system that ensures equitable revenue distribution while encouraging economic growth nationwide.

The Tax Reform Bills

Tinubu had initially forwarded four tax reform bills to the National Assembly on October 3, 2024. These included:

1. Nigeria Tax Bill 2024 – Aims to restructure the country’s tax framework.

2. Tax Administration Bill – Seeks to streamline tax collection processes and enhance compliance.

3. Nigeria Revenue Service Establishment Bill – Proposes reforms in tax enforcement agencies.

4. Joint Revenue Board Establishment Bill – Focuses on intergovernmental revenue coordination.

With the House of Representatives’ approval, the bills are now set to be considered by the Senate. If passed, they could significantly alter Nigeria’s tax landscape, affecting businesses, states, and individuals alike.

What Next?

The approval of the bills marks a legislative victory for President Tinubu, but the backlash from some state governments and economic experts suggests that implementation could be met with resistance. It remains to be seen how the Senate will handle the reforms and whether compromises will be made to accommodate opposing views.

As the tax debate rages on, many Nigerians are watching closely to see how these changes will impact their daily lives and the broader economy.

Stay with Parrot Newspaper for updates on this developing story.