Tinubu Tax: NLC, Afenifere, ACF, Ohanaeze, Others Flood NASS with Memoranda

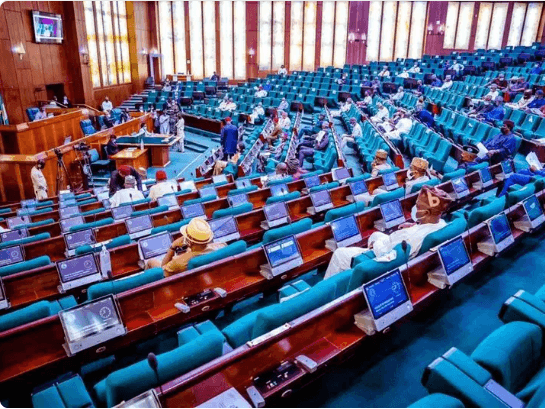

The Nigerian government’s ambitious effort to overhaul the nation’s tax laws has reached a critical milestone. Following the submission of over 200 memoranda by diverse stakeholders, the National Assembly’s public hearings have marked a pivotal moment in the country’s quest to reform its tax system.

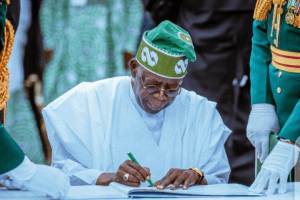

The proposed tax reforms aim to modernize Nigeria’s tax laws, promoting economic growth, reducing inequality, and increasing government revenue. However, the bills have sparked both support and opposition, with stakeholders raising concerns about the potential negative effects on small businesses and middle-class citizens.

*Diverse Stakeholder Voices*

The public hearings revealed a range of opinions on the tax reform bills. Stakeholders such as the National Association of Chambers of Commerce, Industry, Mines, and Agriculture (NACCIMA) advocated for a simplified tax system to ease compliance, especially for small and medium-sized enterprises (SMEs). The Manufacturers Association of Nigeria (MAN) highlighted the need to incentivize local production, while the Nigerian Labour Congress (NLC) called for a progressive tax system to protect low-income earners.

*Key Issues and Concerns*

The hearings spotlighted several key issues, including:

– *Expanding the Tax Base*: How to expand the tax base without increasing rates or overburdening individuals and businesses.

– *VAT Adjustments*: Concerns about the potential impact of VAT adjustments on economic activity and labor supply.

– *Tax Evasion*: Calls for stronger measures to combat tax evasion, particularly among multinational corporations.

– *Transparency and Accountability*: Demands for greater transparency and accountability within the tax system.

*What Lies Ahead?*

As the National Assembly reviews the memoranda and weighs the feedback from stakeholders, the proposed tax reforms remain a work in progress. The aim is to pass legislation later this year that will overhaul Nigeria’s tax system. However, lawmakers must navigate differing views and balance the concerns of multiple groups to create a tax system that is equitable, sustainable, and growth-friendly.

The success of the tax reforms will ultimately depend on how policymakers reconcile the diverse interests and perspectives. As deliberations continue, stakeholders are hopeful that the final reform package will meet the needs of both businesses and individuals, positioning Nigeria for greater economic stability and growth.